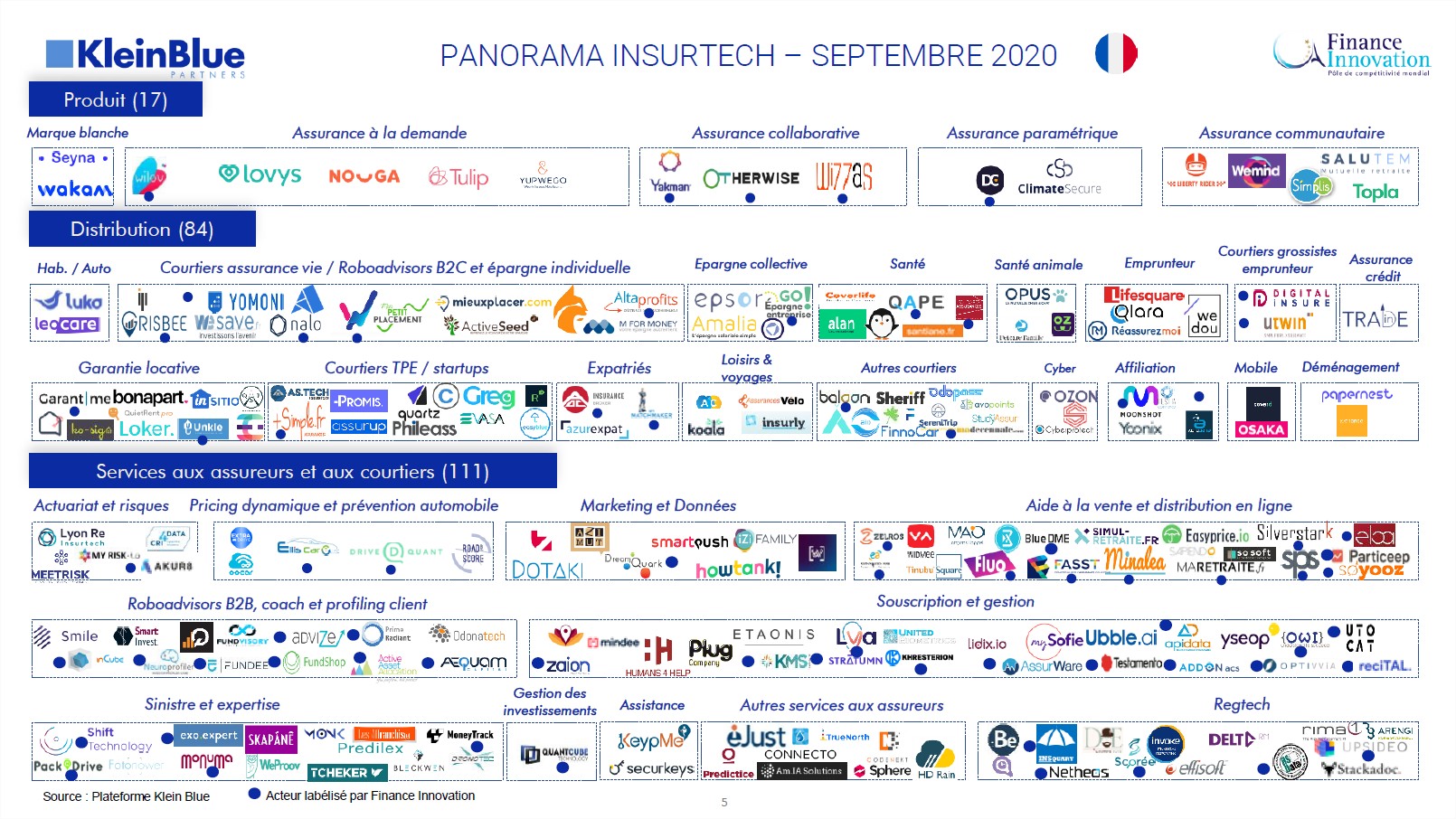

In partnership with the global competitiveness cluster Finance Innovation, the consulting and monitoring firm Klein Blue has unveiled its fourth map of French insurtechs.

The panorama offers a comprehensive view of trends in the insurtech sector including key figures and interviews with historical and insurtech players.

Covid-19, an accelerator of the digital transformation of insurance

According to analysts at Klein Blue Partners, the current covid-19 crisis will play a major role in the digitalization of insurance. Consumers feel distrust of traditional players. This is due to the lack of transparency in insurance contracts during the pandemic. Also, in order to gain the trust of customers, traditional insurance players will increasingly adopt strategies for opening up and digitally distributing their products.

On this last point, Particeep has launched the Particeep Plug solution which allows insurance and banking players to offer 100% online subscription for their products without any IT development.

Insurance for 2025-2030

In a prospective analysis of the insurance sector, Klein Blue Partners predicts that in 2025, the role of the insurer will be more open and broadened by offering new types of services to better serve the needs of consumers (in times of pandemic for example, cyber, etc.)

In 2030, Klein Blue affirms the vision of the insurance market shared by Particeep. In other words, the distribution will not be exclusive to insurers and brokers, but other types of players will be involved. These are new entrants such as GAFA, specialized or non-specialized platforms.

Download the Klein Blue study (in French).