An insight in the Swiss crowdfunding market

As part of our blog, we are looking at the crowdfunding market and regulation of many European countries (check the Netherlands and the UK). In this article, we will have Switzerland as the country of subject. Switzerland is a country in which the crowdfunding market is not far in its developement yet, but seen as a country with a lot of potential as there are many private investors. In this article we will be talking about Switzerland’s regulation, market development and the market players.

The crowdfunding market in Switzerland is still very small and there is not much political interference. As a matter of fact, Switzerland is the first country in our blog without having a base of rules assigned specially for crowdfunding (such as investment limits, investor assessments etc.). What they do require in some cases, is a license by the FINMA.

Crowdfunding in Switzerland regulation

The Swiss Financial Market Supervisory Authority that is in charge of the regulation of financial services is called FINMA. The FINMA is the organization that decides which organization does or does not need a license. It is also responsible for the regulation. So we have been talking about required licenses, but how do you know, as a platform owner, whether you need a license or not? Easily said, the platforms that require a license are the platforms that:

- accept funds for a commercial activity without immediately passing them on to the project developer

- channels funds through a platform operator’s accounts, if the operator renders a professional service, because they constitute a payment transaction service that requires a license

The platforms that do not have this kind of activity are not required to have a license of the FINMA.

For the rest, the FINMA has not yet put together any specific rules for the crowdfunding market. This is because the market is still very small.

The Swiss Market

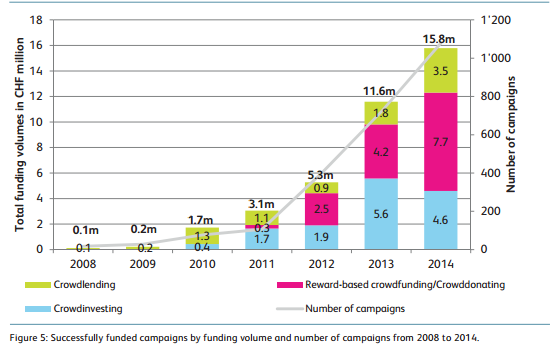

The Swiss market is still a very small market. The graph below shows the developments of the market from the years 2008-2014. As you can see the volume of the market in 2014 was 15,8 million Swiss francs. Which comes back to around 14,4 million euro. In comparison to some of the other European markets it is a tiny market, but tiny doesn’t mean there aren’t any opportunities! The developments over the last 4 years have been strong and can be very interesting for new entrants.

Market development

The graph above shows some interesting facts. Something which really gets my attention is the figures of investment-based crowdfunding in 2014. It seems that investment-based crowdfunding became less popular in this year.

The Swiss crowdfunding market as whole in 2014 had a volume of CHF 15.8 million raised for 1078 projects, which was increase of 36% compared to the year before. To give you an insight in the market developments hereby some statistics (2013-2014):

– Loan-based crowdfunding grew by 95%

– Donation- & Reward-based crowdfunding grew by 82%

– Investment-based crowdfunding declined by 18%

– Donation- & Reward-based crowdfunding cover 49% of the Swiss market

If we compare these development figures to the figures of the Netherland and the UK, it is clear that they are less impressive. Crowdfunding is still in a very early stage but starts becoming a more serious business in Switzerland.

Crowdfunding platforms

As of april 2015 there were approximately 30 crowdfunding platforms in Switzerland. Most platforms are donation- and reward-based platforms. See below the differentes platforms per type of funding:

Investment-based crowdfunding: Bee invested, c-crowd, companisto, investiere, raisers, Swiss-Crowd, Swiss Starter

Donation- & reward-based crowdfunding: 100-days, Basellandschaftliche Kantonalbank (active since late 2014 with the platform miteinander-erfolgreich.ch), Conda, Donobot, fairfundr, Fengarion, GivenGain, GoHeidi, “I believe in you”, Indiegogo, International Create Challenge, Kickstarter, LémaNéo, Moboo, Progettiamo, ProjektStarter, Sosense, Startnext, wemakeit

Loan-based crowdfunding: Cashare (also active in reward-based crowdfunding), CreditGate24, direct-lending, Veolis (also active in other areas), Wecan.Fund .

As you can see there aren’t that many platforms in active in Switzerland, particularly not in loan- and investment-based crowdfunding.

When starting a new crowdfunding platform it is important to know which payment provide to use. Some of the frequently used payment providers in Switzerland are: Paypal, Mangopay and FairGive.

Do we see an opportunity here?

If you; have any questions regarding this article; need more information; or if you are interested in starting your own platform, check our website or just get in contact with us and we will be more than happy to help you!